Frequently Asked Questions

- 2026 BOD Nominations

- About TN Members 1st

- Account Questions

- Annual Meeting FAQs

- ATM Questions

- Audio Access Update FAQs

- Bill Pay

- Checking Questions

- Common Digital Banking Errors

- Community Day Participating Partners

- Debit Card Questions

- Digital Banking Access & Enrollment

- Digital Banking Alerts

- Digital Wallet

- Elan Card Conversion

- Elan Credit Cards

- eStatements

- External Accounts & 3rd Party Providers

- Financial Literacy Questions

- Food Drive with Second Harvest of East Tennessee

- General Product and Service Questions

- Home Banking Questions

- Loan and Credit Questions

- Logging in to Digital Banking

- Member Assistance

- Miscellaneous Questions

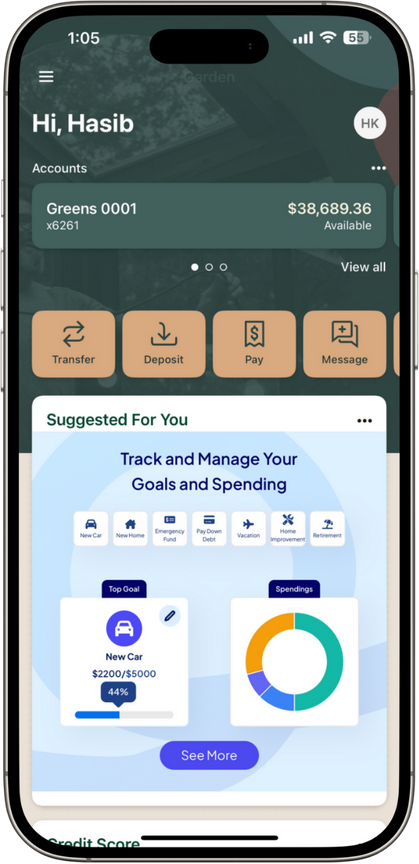

- Nudge Money

- Remote Deposit

- Roth IRA Questions

- Security Questions

- Share Certificate Questions

- Share Certificates

- Shared Branching IDCheck FAQs

- Transfers & Transactions

- Travel

- Updating Information in Digital Banking

The easiest way to access Nudge Money is to log in to your digital banking, online or through our free mobile app, and click the Nudge Money tile on your dashboard.

You can also access Nudge Money by using an internet browser, navigating to mymembersfirst.nudgemoney.com, and clicking "Login with Banno."

No, the Nudge Money platform is free for our members. You will not incur a fee for using the Nudge Money platform. We want all of our members to have access to easy-to-use, informational, and up-to-date resources to help you make the most of your accounts and financial goals.

No, the Nudge Money platform is not a certified financial advisor. Nudge Money is a digital tool that provides a customizable, integrated platform for managing and understanding your financial situation and goals.

If you receive an error message, encounter technical problems, or have issues with the Nudge Money platform, don't hesitate to contact the credit union for assistance. We will collect some information from you, have our Nudge Money Support Team examine the issue, and provide suggestions for a resolution. We will need the following information to submit a support ticket:

- Member name

- Device used (desktop, laptop, tablet, phone)

- Device operating system (Apple, Windows)

- Screenshot of error/issue

Without this information, we may be unable to accurately address the issue.

Inside the Nudge Money platform, in the profile section, your name, birth year, and gender are prepopulated based on the information the credit union has on file for you. If you need to update this information, please contact the credit union at 865-482-4343, via message on digital banking, or by stopping into your local branch to learn what documents may be required to complete those updates.

No, your financial goal score is not the same as your credit score. It is unrelated to your credit score and should not be used as an indicator of credit score. Your Financial Goal Score shows how well you can reach the financial goals you selected within the Nudge Money platform with the information you've included within the Nudge Money platform. Your Nudge Money financial goal score is calculated by running 1,000 simulations to predict the likelihood of reaching your goals and matching them with your current financial resources.

No, logging out of the Nudge Money platform will NOT log you out of your digital banking; however, you may be prompted to log back into your digital banking, depending on if your session has timed out due to inactivity.